“THE PLACE TO INSPIRE, INNOVATE & IMPROVE!”

Innoveren en experimenteren in het BIC-LAB met nieuwe -technologie en -business

Inspirerende plek voor je bedrijfsevent, vergadering, training of workshop

Huur een vaste kantoorruimte of flexwerkplek op de levendige campus

Waarom we dit doen

Nieuwe technologie verandert de wereld sneller dan ooit tevoren. Dat betekent dat deze technologie innovaties voortbrengt die niet langer beter, sneller en goedkoper zijn, maar totaal anders.

De Campus

De Gasfabriek is een Business Innovation Campus. Gevestigde en startende ondernemingen, startups en scale-ups vormen samen een bruisend en innovatief geheel. Er zijn meer dan 75 bedrijven op de Campus gevestigd, bestaande uit ongeveer 500 personen. Een groot gedeelte van deze bedrijven heeft een sterke focus op innovatie en schaalbare IT-Tech. Het plan is om de campus de komende jaren flink door te ontwikkelen. Artist’s impression door Architecten_Lab.

Wat we doen

Het laatste nieuws

Lees hier alles over de laatste ontwikkelingen, activiteiten en meer van De Gasfabriek.

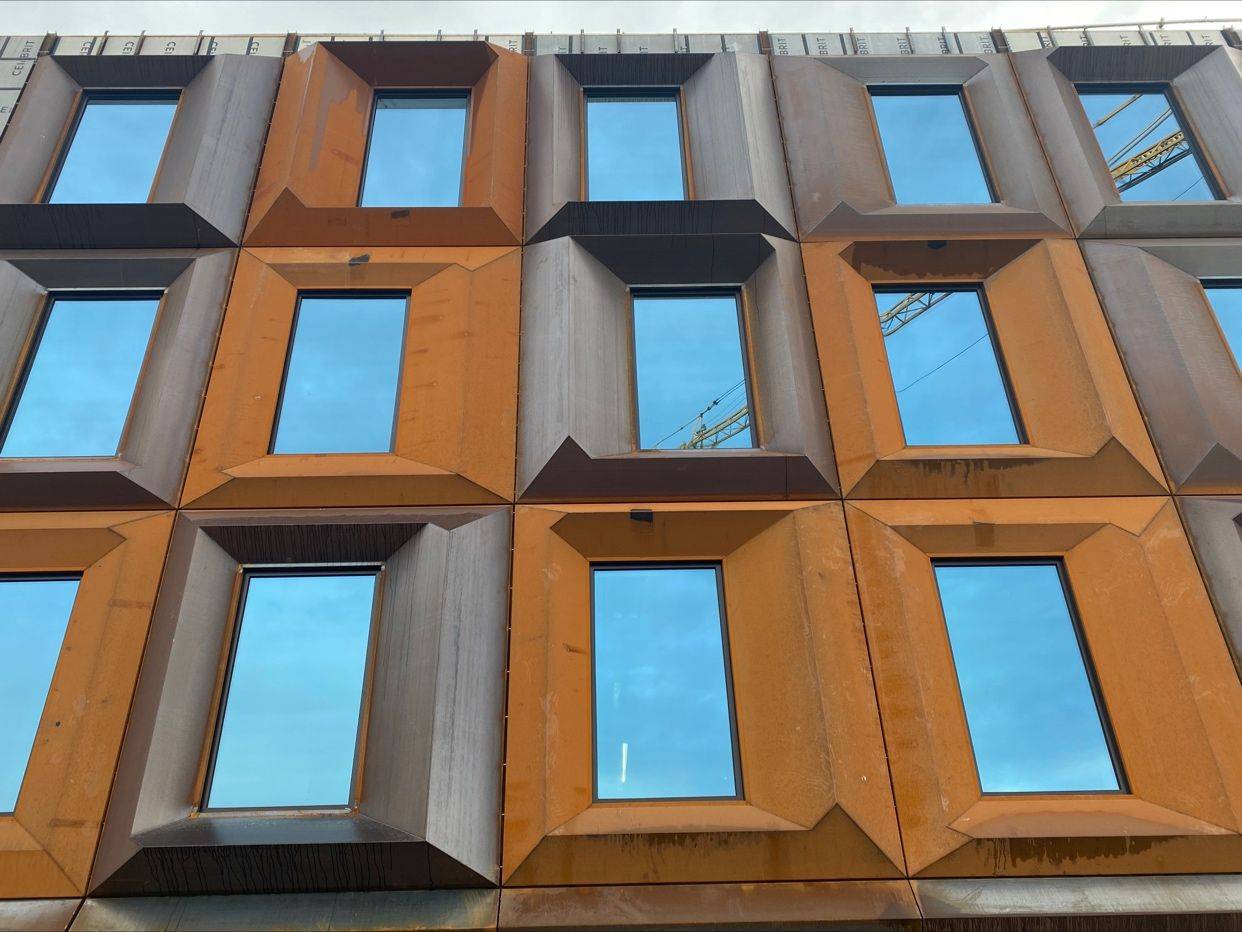

Cortenstalen gevelelementen Gebouw X

De cortenstalen gevelelementen van VPT zijn onlangs gemonteerd bij GEBOUW X op onze Gasfabriek in Deventer.

De binnenspouwbladen zijn gemaakt door Strobox. Eén prachtige StartUp, die met stro geïsoleerd HSB elementen produceert.

Een mooie samenwerking en een prachtig resultaat. Wil je zelf ook ondernemen op onze campus? Neem dan contact met ons op.

Scale-up Brandeniers bestaat 5 jaar

Digitaal Marketingbureau Brandeniers vierde kortgeleden zijn 5-jarig bestaan. Eigenaren Mischa, Koen en Frank waren één van de eerste ondernemers die op onze campus gestart zijn.

Inmiddels bestaat het team uit 14 Brandeniers met klanten over de hele wereld. Gaaf om te zien welke ontwikkelingen zij hebben doorgemaakt.